New taxation rules for the sale and valuation of shares/ownership interests: What changes can natural persons expect in 2025?

The government’s 2023 consolidation package regulates, among other things, the tax exemption of income from the sale of securities/shares. The changes made may lead to an obligation to pay income tax even in the case of the sale of a long-term ownership interest, the sale of which was exempt from income tax under the previous legislation.

The relevant tax changes will come into force on 1 January 2025. Specifically relevant are the provisions of Section 4 (3) and Section 10 (9) of Act No. 586/1992 Sb., on income tax, which newly introduce the option of replacing the standard tax acquisition price with the market value of the security that was sold, determined as at 31 December 2024. This procedure is intended to exclude the retroactive effect of the relevant legislation.

The issue of determining the market value of a share/ownership interest as at 31 December 2024 (including a suitable date for preparing the valuation) is the primary topic of this article.

Definition of market value

In the Czech legislation, market value is defined in Section 2 (4) of Act No. 151/1997 Sb., on property valuation. This is a standard definition comparable to the accepted international definition. In the case of a share/ownership interest, it is simply an estimate of the price obtainable in the sale between independent entities which should be acceptable to multiple buyers.

Determination of market value

Compared to the regular price, the market value can be determined using a wider range of valuation methods – usually income, equity or comparative methods. In the case of actively operating enterprises, the income method based on a financial plan, ideally supplemented by a comparison with traded companies, is generally used in the Czech context.

How is the market value of a share/ownership interest to be proved?

Neither the Income Tax Act nor the Property Valuation Act specifies the method for proving the market value of a share/ownership interest as at 31 December 2024; therefore, the calculation submitted by the security holder is also possible. However, for sufficient strength of evidence, we recommend supporting the market value of the relevant share/ownership interest with an independent valuation report prepared by a valuation expert. This may include, for example, an expert opinion, which is a standard structured document recognised by Czech legislation.

When should a valuation of an ownership interest/share according to market value be prepared?

The provisions of Section 10 (9) of the Income Tax Act require the determination of the market value as at 31 December 2024, and the taxpayer will use this information in the tax returns containing the income from the sale of ownership interests/shares. Therefore, it is advisable to prepare the valuation only when the final accounting statements for the 2024 calendar year are available. At the same time, there is no deadline by which the expert opinion should be prepared, and the common practice of the Czech courts is, for example, to request the preparation of expert opinions with the date of valuation dating five years back or more.

From the taxpayer’s perspective, it is common to determine the market value of the ownership interest/security held as at 31 December 2024 in the course of 2025, which constitutes a regular time difference between the date of the preparation of the expert opinion and the date of valuation. Even the preparation of the expert opinion in the later years preceding the relevant sale does not seem irregular, as the experts preparing the expert opinions regularly deal with the difference between the expected and actual development.

Advantages and Disadvantages of Market Value Determined as at 31 December 2024

Finally, we assess whether the parameter of market value determined as at 31 December 2024 is a suitable criterion separating two different taxation schemes of income from the sale of shares/ownership interests.

As we have already mentioned, market value is a recognised international standard, and there are a number of recommended procedures and parameters used to determine such market value. Therefore, we consider the market value standard to be the best option for the given purpose.

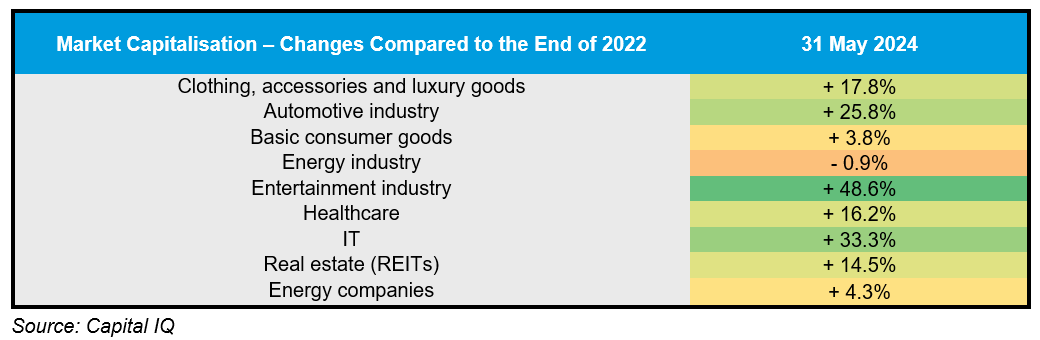

As for the fixed date of valuation as at 31 December 2024, its suitability will be influenced by the market conditions prevailing on 31 December 2024. Our valuation office has long tracked trends in European stock markets using the Capital IQ commercial database. With the crisis following the attack on Ukraine, the market capitalisation of a number of European sectors has fallen by 15% and up to 30% compared to the end of 2021. The table below shows the development of market capitalisation from the end of 2022 to the end of May 2024.

The table shows that, in the course of 2024, a number of sectors are undergoing a phase of growth. In the case of the energy sector, positive developments were already prevalent during the energy crisis in 2022.

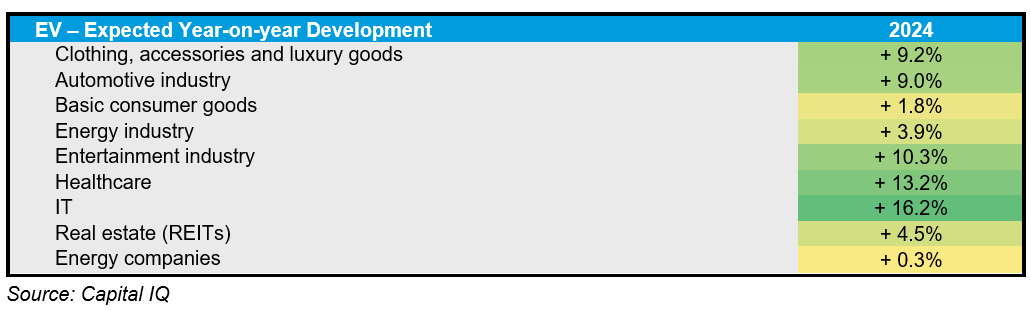

Analysts’ estimates of the development of enterprise value by the end of 2024 (compared to 2023) are also positive.

Unless there is an escalation in the geopolitical situation by the end of the year, the market value as at 31 December 2024 will be a value determined under stable economic conditions and as such will be a suitable criterion of value separating two periods and two different tax schemes. Our valuation office will continue to monitor the development of expectations for the main sectors until the end of 2024, and we will keep you up to date on such information.

Do you have any questions concerning the above issues of valuation, related tax or other valuation tasks (or other topics)? Let us know, and we will be happy to address them together.