How to adjust transfer prices in the face of rising inflation and increasing interest rates

The impact of rising prices of materials, energy, transport and other inputs on the management of enterprises and the economy as a whole is currently a frequently discussed topic. A number of companies are responding to these rising prices by increasing their selling prices and adjusting their sales strategies. However, in addition to rethinking their pricing policy towards customers, companies should not forget to change the transfer price settings for related party transactions.

Transfer prices in a group of related parties should be set in accordance with the so-called arm’s length principle, i.e. they should correspond to price setting between independent entities. Similarly, the response to a change in market prices in the case of a group should be consistent with what independent companies in the market would do under identical conditions. In practice, this means that if a company increases prices following an increase in the price of inputs, it should always also consider adjusting prices for intra-group customers. Especially if these prices are set up as fixed. When making changes, it is then necessary to take into account whether the factor in question also affects sales to group customers, or whether it is only applied to customers outside the group (e.g. certain marketing costs, different transport methods, etc.).

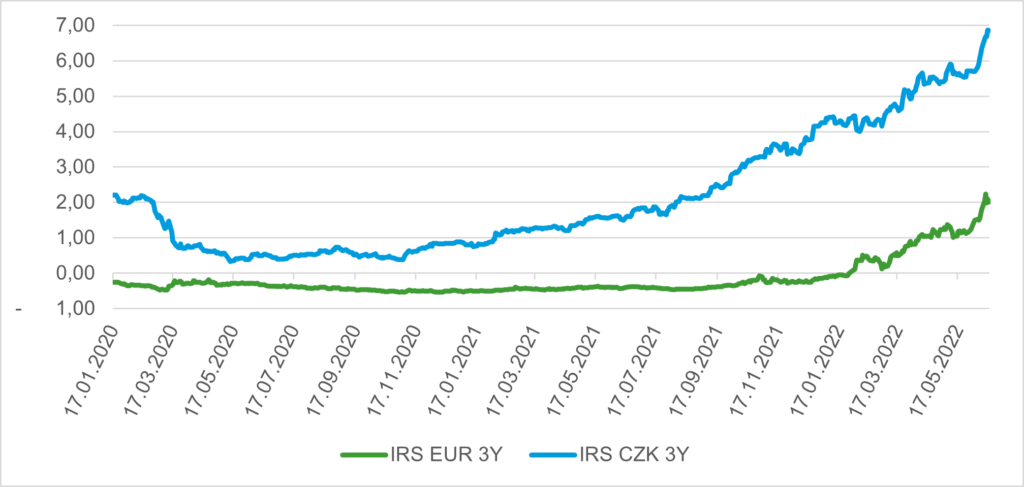

The same is true for interest rate increases. In the case of intra-group loans, groups lending to each other at a fixed interest rate should pay particular attention. Given the dynamic evolution of base interest rates (see the evolution of the 3Y IRS CZK and 3Y IRS EUR rates in the chart below), it could happen that these fixed intra-group rates will be lower than the base interbank rates and thus will not comply with the aforementioned arm’s length principle.

When interest rates are properly set as the sum of the base rate and a risk margin (spread), the interest rate also includes remuneration for providing funds to a borrower with a given credit risk. Interest rates on currently granted short-term intra-group loans in CZK should thus be above 5%.

Don’t know how to set the transfer prices? Need to consult your current transfer pricing policy? Do not hesitate to contact us; we will be happy to help!