Transfer pricing: How are transfer prices and royalties for intangible assets set properly?

The Tax Authority reported in its press release that it made 570 transfer pricing inspections in 2023, assessing an additional CZK 720 million in taxes to those inspected. Obviously, transfer prices, i.e. prices set between related parties, remain in the Tax Authority’s spotlight.

The Tax Authority states that the 2023 inspections centred on advertising services and the licensing of intangible assets. Specifically, examples are mentioned in which a Czech taxable entity creates an intangible asset, such as software, technical solution or trademark, which it then sells to a related company abroad for a minimum price and pays the related company high royalties in return. This arrangement may qualify as an attempt to lower the Czech taxable entity’s tax base. Both of these transactions must take place in accordance with the arm’s length principle, i.e. both the price for selling the intangible asset abroad and the subsequent royalty for using the intangible asset must be set at an amount that independent parties would be willing to accept in an identical transaction and under identical terms.

What to base the prices on?

The price for software or trademark and royalty rates for using the same, i.e. a license fee, can be determined, for example, with reference to publicly available license agreements concluded between independent businesses operating in a similar market. RSM CZ uses the RoyaltyRange commercial database for this purpose.

The resulting rates depend on the type of intangible asset and the contractual terms, with the industry in which the intangible asset is used also being an important aspect. For example, a trademark royalty plays a significant role for a business focusing on consumer goods and services, since the value of the trademark (brand) may create up to 50 per cent of the value of such business.

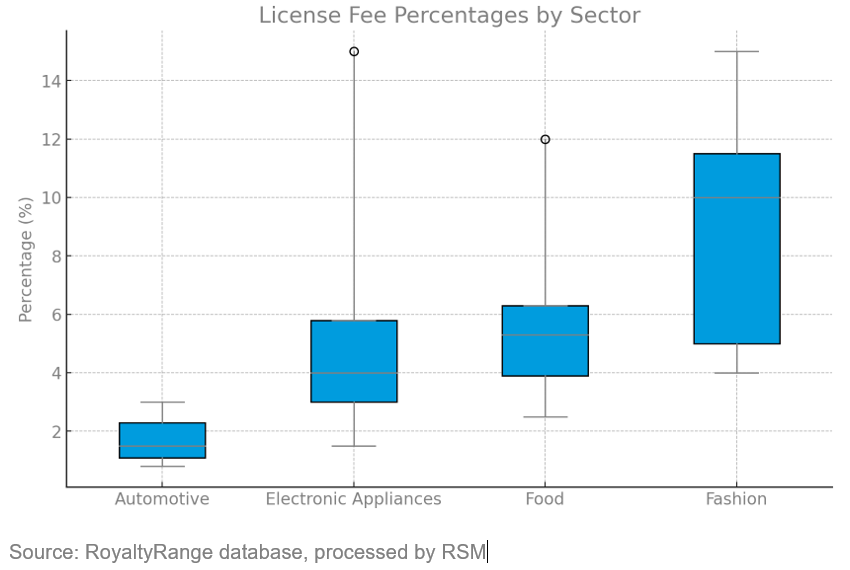

Royalty rates are most commonly derived from the licensee’s sales. The following chart shows the differences between the typical trademark royalty rate related to sales in selected sectors – automotive, electronic appliances, food and beverages, and fashion and jewellery.

In all cases, these are royalties in consumer sectors that focus on the end consumer and where the trademark can be expected to have a major impact on sales. However, it is obvious that the actual rate of typical royalties related to sales differs significantly. Similar results can also be expected when determining a royalty for software or technical solution. When it comes to determining royalties and valuating intangible assets, we recommend that you always get in touch with experts able to perform a comparative analysis of market data in the industry relevant to the particular intangible asset.

Need to set up or discuss your transfer pricing policy? Feel free to contact us. We are happy to help.