Planning a business transformation? Leaving your opening balance sheet to experts is the right choice

03.02.2021

Mergers and divisions of companies are governed by Act 125/2008 Coll., on Transformations of Commercial Companies and Cooperatives (“Act on Transformations”). Many investors find this to be a highly attractive area in terms of impacts connected with acquisitions, yet it may prove complex and time-consuming. A business transformation means a merger by acquisition or absorption (a merger of two or more companies), a full or partial division (the company is divided or some of its business activities are spun off, and a combination of a full or partial division), a transfer of assets to a partner, a change in the legal status (e.g. from a limited partnership business entity to a limited liability company) and a cross-border conversion.

As these examples show, the accounting and tax periods and the entry of the transformation into legal effect may vary, depending on the decisive date. Selecting a wrong decisive date may lead to an unexpected increase in tax liability or administrative burden for the companies involved in the transformation.

As these examples show, the accounting and tax periods and the entry of the transformation into legal effect may vary, depending on the decisive date. Selecting a wrong decisive date may lead to an unexpected increase in tax liability or administrative burden for the companies involved in the transformation.

The most common reasons for a business transformation include:

- A completed acquisition of a new company and its integration into the owner’s existing structure,

- Intra-group restructuring,

- Preparations for the sale of a portion of assets.

- Selecting a decisive date for the transformation,

- Scheduling the transformation (i.e. planning the correct sequence of individual steps, the accounting, expert, tax and legal tasks connected with these steps and their correct timing, and professional coordination and communication of all the transformation team members, including communication with banks and notaries public, the reporting obligation, registration, deregistration and other mandatory steps),

- Having the company’s assets valued if necessary (the Act on Transformations explicitly sets out the circumstances in which assets must be valued by an expert),

- Preparing the opening balance sheet and notes (application of expert valuation, appropriate equity structuring, application of tax deferral, etc.),

- Coordinating the activities with auditors (in the case of a statutory audit) and tax and legal advisers,

- Preparing the transformation project (the project must be filed in a public register and published in the Commercial Journal at least 30 days prior to the date of the general meeting that will approve the transformation; this is followed by the transformation being registered in the Commercial Register).

Determination of a decisive date

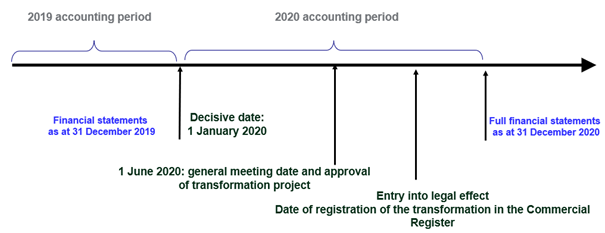

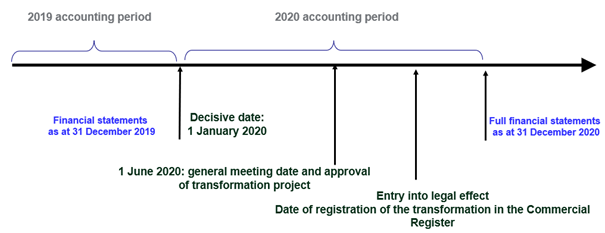

Selecting what is called a decisive date (also referred to as “DD”) is one of the key moments in the transformation process. The decisive date causes the transformation to be effective from an accounting perspective. From the legal point of view, the transformation does not take effect until it is registered in the Commercial Register. The decisive date cannot be determined arbitrarily. The decisive date must be no earlier than 12 months prior to the filing of an application to register the transformation in the Commercial Register and no later than the day on which the transformation is registered in the Commercial Register (in this case the decisive date coincides with the date of the transformation’s entry into legal effect). The following examples show possible ways to determine the decisive date:- Retrospectively, at the beginning of the accounting period (the DD predates the project preparation); the opening balance sheet according to the example below will be prepared as at the DD, i.e., as at 1 January 2020 and prior to the preparation of the transformation project.

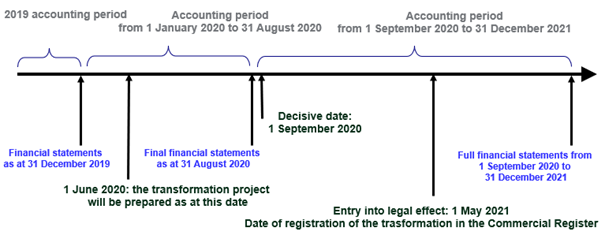

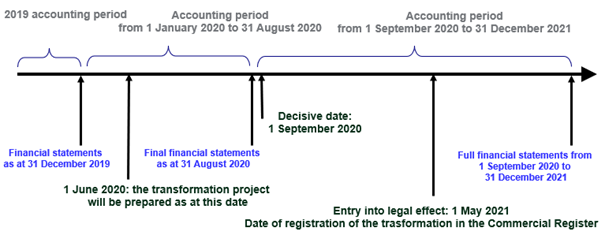

- Forward (the DD falls on a day other than 1 January); the opening balance sheet according to the example below will be prepared as at the DD, i.e., as at 1 September 2020, after the transformation project preparation date.

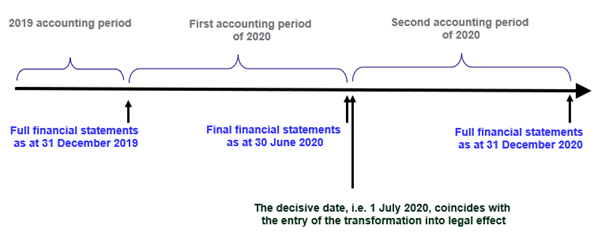

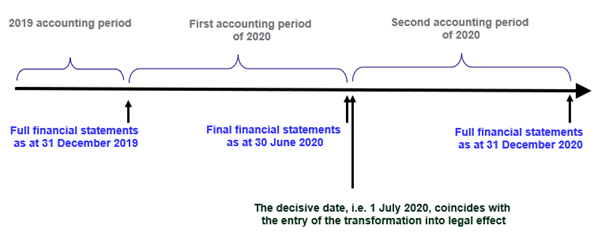

- The decisive date coincides with the entry of the transformation into legal effect, i.e., with the day on which the transformation is registered in the Commercial Register; the opening balance sheet according to the example below will be prepared as at the DD, i.e., as at 1 July 2020, after the transformation project preparation date.

As these examples show, the accounting and tax periods and the entry of the transformation into legal effect may vary, depending on the decisive date. Selecting a wrong decisive date may lead to an unexpected increase in tax liability or administrative burden for the companies involved in the transformation.

As these examples show, the accounting and tax periods and the entry of the transformation into legal effect may vary, depending on the decisive date. Selecting a wrong decisive date may lead to an unexpected increase in tax liability or administrative burden for the companies involved in the transformation.