Payroll changes in 2020

13.01.2020

Dear clients,

We would like to inform you in a simple and concise form about the changes and news regarding the payroll agenda valid as of 1 January 2020:

Increase in minimum salary

- The minimum monthly salary for full-time work will grow from the existing

- CZK 13,350 to CZK 14,600

- The hourly rate will grow from CZK 79.80 to CZK 87.30

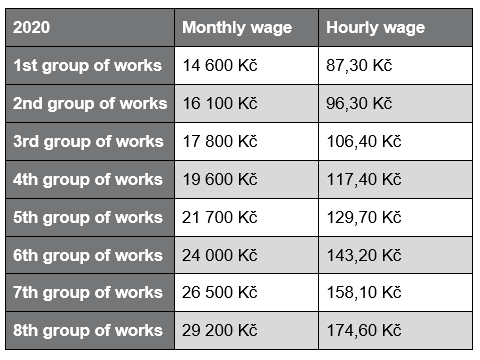

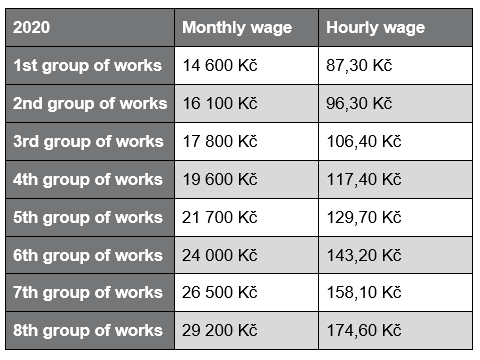

Increase in guaranteed salary

Maximum assessment base for 2020

- The maximum assessment base for social insurance in 2020 is CZK 1,672,080

- The amount above which an employee pays monthly solidarity taxes is CZK 139,340

Sickness pay and salary compensation will grow

- As of 1 January 2020, the amount of the sickness pay and salary compensation has also changed. A higher amount from your earnings will now be counted, thanks to the increase in the reduction limits for the salary compensation calculations.

- With effect from 1 January, salary compensation and sickness pay will also grow for those on long-term sickness leave

“E-neschopenka” electronic compensation system for workers

- This only applies to incapacity for work

- Nursing, maternity and paternity benefits – all documents will continue to be issued in paper form

- Part II remains in paper form – i.e. a certificate of an insured employee incapable of work

- The existing parts III and IV of the certificate have been cancelled

- Report new employees on time

- When the period of an employee’s incapacity for work ends, it is necessary to report the date of the commencement of work and whether the employee worked during the period of his or her sickness

- Employees who are paid in cash will have to report the SSZ account number for the benefit payment for each period of sickness lasting longer than 10 working days

- The Annex to the sickness benefit application form now includes the employee’s bank account number

Access to the electronic workers compensation system = communication via portal

- Data box

- Nia (National Identity Authority)

- E-ID card

- Username and password – validation via Checkpoint

Communication within the electronic compensation system for workers (data collection)

- Via the electronic portal of the Czech Social Security Administration

- Via data box

- Via automated communication through payroll or HR SW

Changes in individual income tax

- Small-scale dependent activities – up to CZK 3,000 gross will not be subject to insurance (limit of CZK 2,500 for withholding tax – increase also to CZK 3,000 amendment, effective from the month following the month of effectiveness)

- Tuition fees for the given tax period 2019 (max. 13 350 CZK, increase of the minimum wage from 12 200 CZK), for 2020 in the amount of 14 600 CZK. The confirmation must newly include the date of enrollment of the pre-school facility in the school register or register.

- Tax bonus per child – the condition is an annual income of at least 87 600 CZK (beware since 2018 can only have income from employment or business), monthly income of at least half the minimum wage (7 300 CZK)

Electronic taxpayer’s statement

- Since 2018 it has been possible to complete and sign the taxpayer’s statement electronically

- Check out our simple PAYMINATOR online solution